기업

LG Chem to Acquire AVEO for $566M, boosting entry into the U.S.

by Sungmin Kim

Acquisition Provides LG Chem’s Life Sciences Division a Commercial Footprint in the U.S...Transaction Price Represents a 43% Premium

LG Chem and AVEO Oncology announced on the 17th that they have entered into a definitive agreement under which LG Chem will acquire AVEO for $15.00 per share in an all-cash transaction with an implied equity value of $566 million on a fully diluted basis.

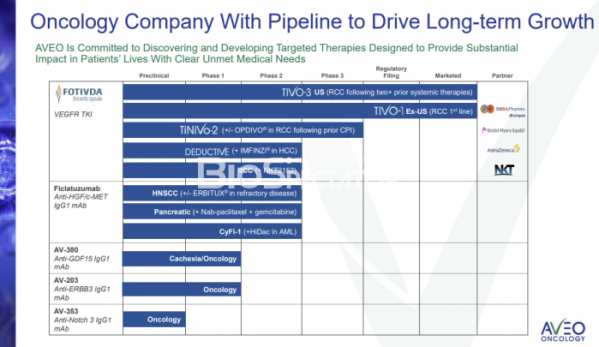

The combination of LG Chem’s Life Sciences division and AVEO is expected to create a global oncology organization with a robust portfolio of innovative products supported by full capabilities from discovery to clinical, biologics manufacturing and U.S. commercialization, at a scale capable of broadly delivering on its mission to improve the lives of patients with cancer. Bringing together AVEO and LG Chem is expected to extend LG Chem Life Sciences’ commercial footprint to the U.S., diversify its pipeline with a broad range of oncology therapies and accelerate LG Chem’s efforts to deliver continued growth through the development and commercialization of world-class cancer therapies.

Through this transaction, AVEO will immediately establish LG Chem’s commercial presence in oncology through AVEO’s lead product, FOTIVDA® (tivozanib), which received U.S. Food and Drug Administration (FDA) approval in March 2021 for the treatment of adult patients with relapsed or refractory advanced renal cell carcinoma (RCC) following two or more prior systemic therapies. In addition, the combined company will have significantly greater resources to develop and commercialize both companies’ robust clinical pipelines of innovative oncology medicines.

Upon completion of the transaction, AVEO will establish and operate as the U.S. commercial foundation for LG Chem Life Sciences’ oncology segment. Through this transaction, the combined company will expand its high-value and sustainable pipelines in oncology and bring cancer therapies to patients in need.

“With its track record of clinical success, deep pipeline of innovative therapies and continued growth trajectory following the successful commercialization of FOTIVDA®, AVEO is the perfect partner for LG Chem Life Sciences,” said Shin Hak-Cheol, Chief Executive Officer of LG Chem. “This transaction represents the next step in our portfolio transformation towards higher growth markets and provides a strong commercial foundation in oncology as we continue to develop our anti-cancer offerings. We remain focused on prudently investing in our R&D capabilities, continuing to build a leading portfolio of therapies and transforming lives through inspiring science and leading innovation. With our shared values of collaboration, agility and passion, we are excited to welcome AVEO and its talented employees to LG Chem as we continue to advance our sustainable goal of becoming one of the top global pharmaceutical companies.”

“We are thrilled to announce this transaction, which delivers a compelling all-cash premium to our shareholders, while positioning AVEO to accelerate our strong momentum to the benefit of the oncology patients we serve,” said Michael Bailey, President and Chief Executive Officer of AVEO. “By joining forces with LG Chem, AVEO expects to have significant financial and development resources to help AVEO fully realize the tremendous potential of our promising pipeline. LG Chem shares AVEO’s deep commitment to patients and vision of developing innovative therapies designed to provide substantial impact in the lives of cancer patients with clear unmet medical needs. This transaction is a testament to the extraordinary efforts of our employees, who will play an integral role in the success of the combined company. We look forward to entering our next chapter of growth with the support of LG Chem.”

“This transaction represents the culmination of a thorough review of opportunities by the Board to maximize shareholder value and delivers compelling value to AVEO shareholders,” said Kenneth Bate, AVEO’s Chairman of the Board. “We are confident that with the support and resources of LG Chem, AVEO will continue advancing its mission of passionately pursuing a better life for patients with cancer.”

LG Chem is actively advancing multiple clinical and pre-clinical stage anti-cancer therapies. LG Chem will be able to harness the full potential in oncology through this transaction and become a global, fully integrated – from R&D to commercial stage – pharmaceutical company.